How to Write the Perfect Trading Plan

Posted By: Steve Burnson:

This is a guest post by Sami Abusaad of @T3Live

When the market turns unstable, what do you do?

Panic sell? Seize the moment and start gambling?

If you want to wade through the treacherous waters of a volatile market and come out with your P&L — and your dignity — intact, you need a trading plan.

Creating a trading plan can help you reset so you can take advantage of market volatility.

I can’t guarantee that a trading plan will make you successful.

But I can guarantee that you’ll fail if you don’t have one.

This is an ambiguous topic that a lot of people struggle with, including myself in the beginning.

In this article, I’ll show you how to make a trading plan that will work for you.

HOW TO WRITE THE PERFECT TRADING PLAN

Most people are terrified to make a trading plan.

Once you commit to a plan, YOU are responsible for the results. As humans, we prefer to avoid taking responsibility when things don’t go our way.

But when you have a plan that tells you what you can and cannot do, you have no choice but to take responsibility.

In this process, your ego will get bruised and you’ll have no one to blame but yourself.

This is required for growth.

A plan is ESSENTIAL to boosting your P&L long term.

Having a plan will allow you to move forward systematically.

You’ll be able to notice what is working and do more of it. You’ll also notice what isn’t working and eliminate it from your trading.

As you look over my trading plan, keep these things in mind:

- This is a template to create your own plan

- Start conservatively. Set easy, modest goals and create simple rules.

- Tweak your plan as you gain experience

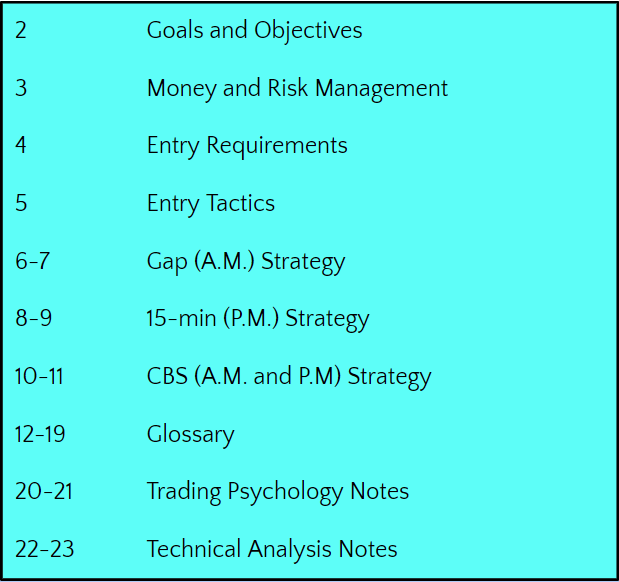

My Trading Plan Table of Contents:

GOALS AND OBJECTIVES

To start your trading plan, define your goals and objectives.

“Goals” are your overarching intention. “Objectives” are the criteria you need to establish so you can meet those goals.

My Goal:

Trade well by finding setups that strictly meet my strategies (as outlined in my trading plan), and execute them flawlessly.

My Objectives:

Batting Average: >= 60%

Sharpe Ratio >= 2.0

Risk to Reward >= 1:2

# of Trades/Day: 7

* Sharpe ratio – the average winning trade divided by the average losing trade

* Risk – the difference between entry price and stop price

* Reward – the difference between entry price and target price

You can tweak these objectives to best suit your lifestyle and reach your goals, but I find it’s best to avoid improving one stat at the expense of the others.

There are four things that make money:

- The frequency of your trades

- The risk per trade

- The Sharpe ratio

- Your hit rate

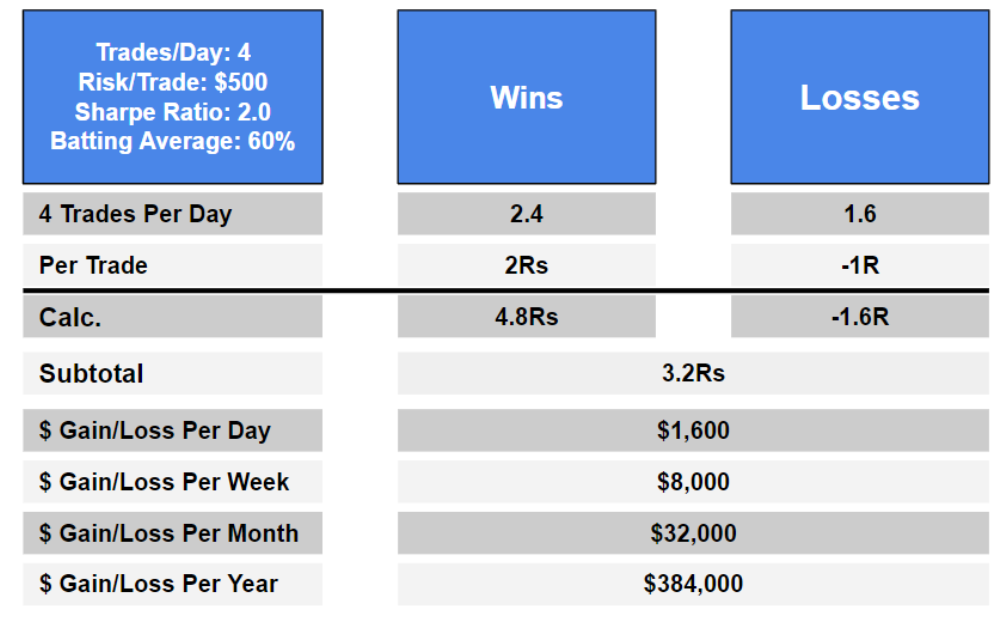

Below are some examples of how altering just one of these factors can drastically impact your P&L:

In example 1, by hitting those four metrics in one year, you can make over half a million dollars (gross).

In example 2, if your risk per trade doubles, your gross profit doubles.

In example 3, by reducing your number of trades per day from 6 to 4 (by only jumping on the “perfect trades”), you see a 33% drop in your P&L.

In example 4, if the Sharpe ratio changes from 2.0 to 1.5, P&L is again severely impacted.

In example 5, if the batting average is lowered from 60% to 50%, P&L again drops by one third.

By even slightly messing with these four metrics, your gross profits can be altered dramatically.

Step by step, set goals for yourself to see if you can improve these metrics over time.

MONEY AND RISK MANAGEMENT

This is what keeps the account safe. These are rules that tell you when you need to quit.

My Goal: 2R’s per day, or 10R’s per week

Figure out how you are going to protect the majority of your gains for the day.

When unrealized gains (gains on open positions) reach 2R’s, I trail to protect gains to break even.

ex: If I am up 5R’s, my stop goes up to 3R’s

I also have rules for realized gains

ex: If I am up 5R’s, I protect 4R’s

I have rules for Open Exposure, rules for Maximum Loss for day and week, and what to do if they are reached.

In the past, when I maxed out for the day or week, I would “escape,” not wanting to face the music and take responsibility.

Now I have rules in place to prevent me from experiencing maximum losses and help me get back on track if I do.

ENTRY REQUIREMENTS

In order to enter a trade, I look for:

A trade that fits a strategy in my trading plan and has a clear setup

ex: if i have a gap strategy, that doesn’t mean I can trade anything that gaps. I have to have a clear setup.

A stock that has hit the entry price (unless it’s a base breakdown or the stock is on an uptick).

NO RE-ENTRY unless it’s a Climactic Buy or Climactic Sell Setup.

Most people are better off not trading the same positions because they end up “revenge trading.” Instead of taking a small loss, they end up taking a huge loss.

Decide for yourself what will make you pull the trigger on a trade. What does the chart need to look, feel, and smell like?

ENTRY TACTICS/STRATEGIES

The bulk of my trading plan is made up of three strategies that best suit my personality.

Gap strategy for the morning session.

15 min Strategy to plan certain strategies off the 15 minute chart. I chose this strategy because it’s the perfect length of time for trading in the afternoon. Stops and patterns don’t hold on shorter time frames later in the day.

Climactic Buy Setup I use for late morning and early afternoon.

List any and all entry criteria for your patterns and strategies. I have different criteria for different strategies.

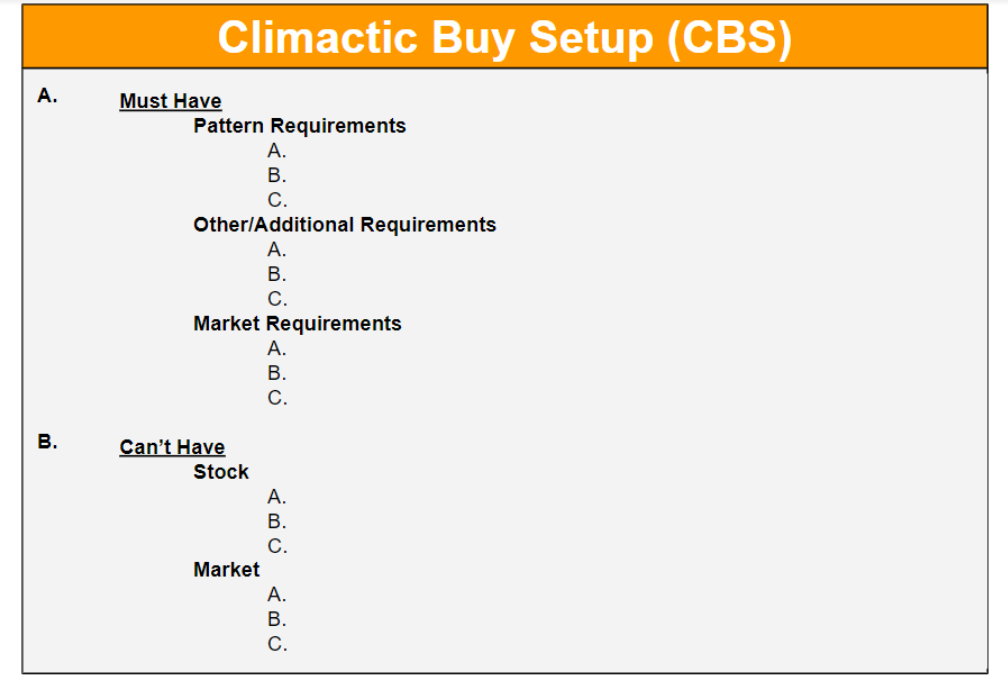

Below is an example of how I document the different criteria for one of my strategies, the climactic buy setup (CBS):

Must haves:

Pattern Requirements: (What does the chart need to look like?)

- For CBS, how many red bars in a row should you see?

- Do the bars need to be getting progressively bigger?

- How far does the price need to be from the 20?

Other/Additional Requirements:

- Stock’s relative weakness to the market?

- Multiple time-frames?

- Does the daily chart need to look a certain way?

Market Requirements:

- What are the ideal market conditions for CBS?

Can’t Haves:

Stock:

- List the “can’t haves” for the stock

Market:

- List the “can’t haves” for the market

Would Like to Have: (optional criteria)

Stock

- for CBS, the daily is extended on both the daily and 5-minute chart

Market

- for CBS, market is extended toward the downside

Trade Metrics:

Entry: Wait for prior bars high to get breached? What time frames are you using?

Stop: Low of the day

Target: Where are you going to exit?

Management: If you get into a trade without knowing in advance how you will measure it, it will be very difficult to manage it well. You’ll end up trading randomly, which is not compatible with successful trading.

This isn’t a walk in the park as many “influencers” would have you believe.

This is a real business. Be thorough, systematic, and put in the time it requires. Eventually, remembering your own strategies will become second nature.

GLOSSARY

This is where I keep all the definitions for every term I use in my trading plan.

Pre-define terms like “strong stock” or “strong support” so you won’t have to guess if a stock is strong in the heat of market hours.

This is something to work on over time – Rome wasn’t built in a day and your trading plan won’t either.

The remainder of my trading plan is notes I’ve collected over the years that I like to revisit from time to time.

Now that you have an outline, make your own trading plan!

When in doubt, keep it simple and conservative.

HOW A TRADING PLAN WILL HELP YOU MAKE MONEY

The P.E.A.R. Strategy:

Write your trading plan.

Execute a batch of trades.

Analyze your results – figure out what is working and what isn’t.

Refine your plan – once you’ve analyzed the trades, make necessary adjustments and apply them to your plan.

Using this strategy will improve your trading plan over time, which will grow your P&L. You will slowly learn what causes you to lose money and eliminate it from your plan while keeping the things that work.

CAUTION: DON’T TRY TO MAKE THE “PERFECT” TRADING PLAN

For the first two years of my trading career, I adjusted my trading plan every day while finding what worked and what didn’t.

Everyone who starts trading wants to make money right away.

Instead, focus on experimenting.

Try different ideas.

There are many ways to succeed in trading. You have to find your own path and adjust your plan as you go along.

So, start with a simple plan and evolve over time. Make conservative goals for yourself. Measure your results. Keep the good and eliminate the bad.

With time, you’ll have a trading plan that works for you.

'거래기술에 관한 정보' 카테고리의 다른 글

| Best Moving Average Crossover For Swing Trading(스윙 트레이딩을 위한 최고의 이동 평균 크로스오버) (0) | 2021.10.06 |

|---|---|

| Why Compound Interest is the Eighth Wonder of the World(복리가 세계 8대 불가사의인 이유) (0) | 2021.10.04 |

| The Millionaire Next Door Formula(백만장자 옆집 공식) (0) | 2021.10.02 |

| Sturgeon’s Law: 스터전의 법칙 ; Why 90% of Traders Lose Money: 거래자의 90%가 돈을 잃는 이유: (0) | 2021.10.01 |

| Diamond Pattern Explained(다이아몬드 패턴 설명) (0) | 2021.09.30 |