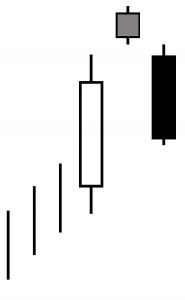

The RSI divergence indicator helps stock traders spot(발견하다) and take advantage of investment divergence. When used correctly, RSI can be one of the most effective trade and confirmation indicators in your arsenal. RSI is one of the most popular tools in swing trading, a technique in which traders ride out(이겨내다) the markets in order to make the best possible moves. RSI 다이버전스 지표는 주식 거래자들이 투자 다이버전스..